If your team is spending too much time forecasting and re-forecasting using a cumbersome tool or process, then it’s going to be hard to keep your S&OP process as a whole moving at the pace you need.

Mary Kate Kloeblen

TLDR:

When people think about supply chain, S&OP isn’t usually the first thing on their minds. But the more predictable your sales are, the less reactive your supply chain has to be.

When people think about supply chain, S&OP isn’t usually the first thing on their minds. Yet it’s one of the most important determinants of supply chain robustness: the more predictable your sales are, the less reactive your supply chain has to be.

Mary Kate Kloeblen was the Senior Director of Operations Modern Age, having previously led the operations and supply chain teams at Cabinet Health and LOLA. She’s led countless S&OP cycles. Here are her reflections on how she has done this successfully:

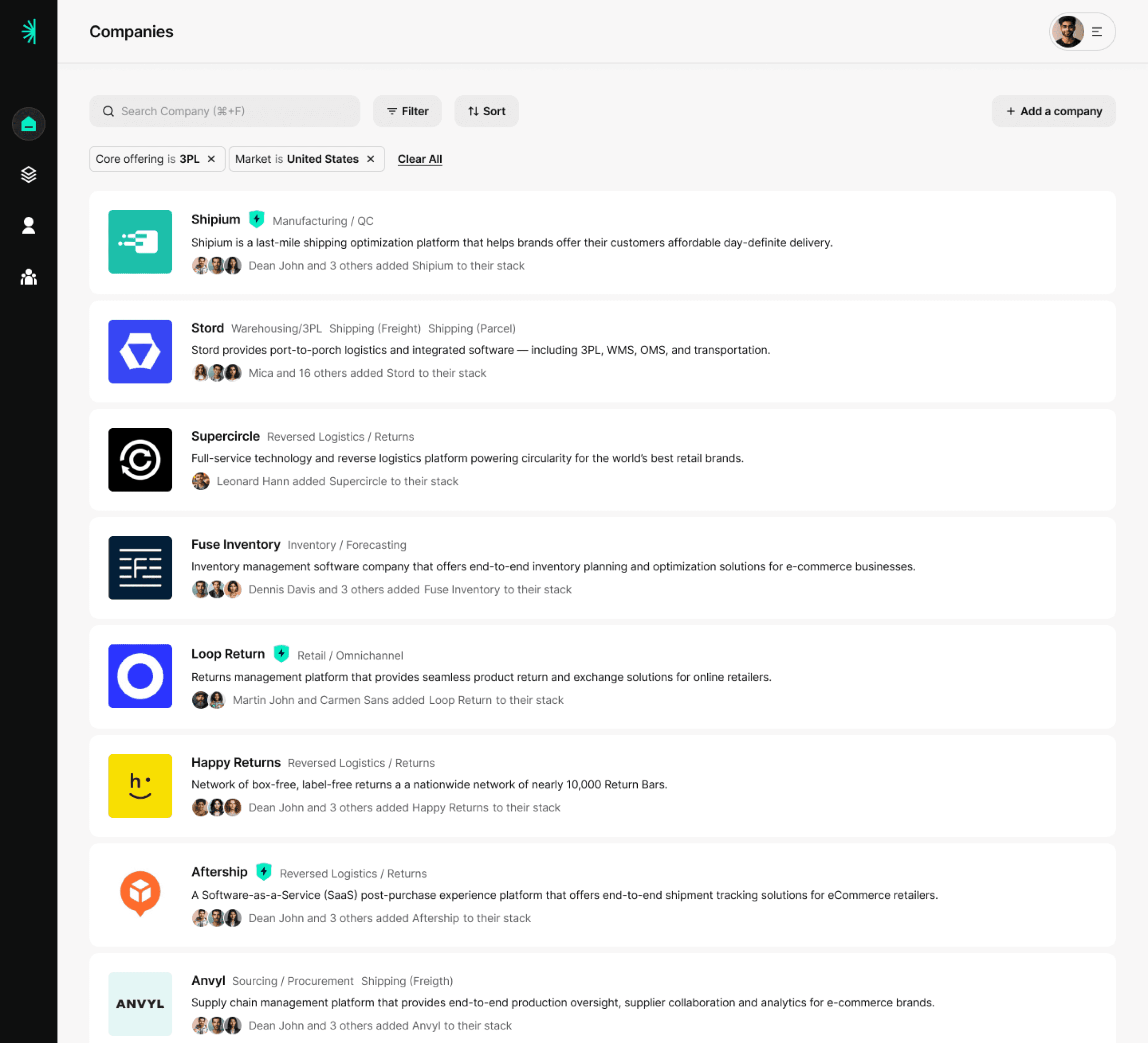

1️⃣ Build points of collaboration cross-functionally and within your internal supply chain team

I like to achieve this through a regular cadence of 3 types of meetings:

Hindsights

Consensus

Executive alignment

The structure of these meetings can vary depending on org size and complexity. As a baseline, I’d recommend at least having 1-2 meetings monthly that cover Hindsights and building Consensus. Executive alignment may not be to be a full meeting in itself.

As the business complexity grows, then I’d recommend splitting each of these meetings out into their own scheduled time on a monthly basis:

First, Hindsights during the first week of the month that covers prior month.

Then, Consensus with re-forecasting and impacts built present to build group alignment on which forecast/strategy to move forward with between the 2nd & 3rd week of the month

Finally, Executive Alignment with the consensus forecast and impacts presented to gain final sign off from the exec team on how to proceed during the last week of the month.

This is the meeting cadence I’ve settled in on after re-building the S&OP process at a number of different orgs now.

2️⃣ Get buy-in about the process from your whole team

Treat your S&OP process as a cultural shift for your organization.

One true thing about cultural shifts is that they're rarely successful without executive buy-in. This is obviously easier said than done — especially if there are execs in the org who don’t understand the value of this process, or view it as a waste of time.

When it comes to convincing teammates, I’ve had success by framing both the benefits, as well as the (very real) opportunity costs and downsides with as much quantified detail as possible.

Gathering feedback from your teammates involved in the process and ensuring their insights are valued and considered is a really important way to build rapport and buy-in. Changing things without pausing for feedback and continuing to adjust the process accordingly usually doesn’t bode well.

3️⃣ Build or use tools that enable you to bring all the necessary data into one place…

Ultimately you want transparency around how sales plans impact operational planning and ultimately the P&L.

The tools that I’d recommend will vary based on company size/complexity. I think most small companies will likely start out with using a series of connected Excel models to connect sales to inventory to finances, and Excel definitely is a powerful and sufficient tool to use in these instances.

As companies grow further, I recommend looking for a combination of a forecasting platform (my favs are Atomic Supply for DTC supply planning and Supply Pike for big box retailer supply planning) and a “lighter” ERP (I know Netsuite & Microsoft Dynamics 365 have a hold on the market here so would likely end up recommending one of those!)

At the end of the day, the outputs of your tools also need to be accurate to ensure credibility of the process is established and maintained. This is so important for cross-functional buy in!

4️⃣ …but don’t let your tools bog you down

If your team is spending too much time forecasting and re-forecasting using a cumbersome tool or process, then it’s going to be hard to keep your S&OP process as a whole moving at the pace you need to make informed decisions.

If something isn’t working — change it! You could try down-resing your forecasts to just capture the “80/20” inputs, or experiment with different tools.

5️⃣ Don’t get tunnel vision in your company’s historical data

It’s impossible to make comparisons to where your business was last quarter or last year if the business is continuing to scale and materially change as it grows. Ensure you’re tempering historical data with inputs from your cross-functional teams such as marketing plans, data from your sales teams, etc. to get closer to a more realistic place to forecast off of.

Did you find these tips useful? Follow Mary Kate on LinkedIn to learn more from her. And subscribe to the StartOps newsletter to catch future articles like this.